Dr. Brynn Winegard | New Retail Realities a Challenge: Driven by ‘So-Lo-Mo’ Millennials

Today’s guest blog is courtesy of business brain science expert Dr. Brynn Winegard. She is an award-winning professor who specializes in explaining everyday work and life phenomena using the secrets of brain science, all with aim of making her audiences happier, healthier, wealthier, and more successful. In this blog, Dr. Winegard looks at the convergence of physical and digital shopping.

Today’s guest blog is courtesy of business brain science expert Dr. Brynn Winegard. She is an award-winning professor who specializes in explaining everyday work and life phenomena using the secrets of brain science, all with aim of making her audiences happier, healthier, wealthier, and more successful. In this blog, Dr. Winegard looks at the convergence of physical and digital shopping.

It’s evident everywhere you look — people shopping online, via digital networks, through their mobile phones. 85% of shoppers indicate that they have at some point used a mobile device while shopping to validate or research their consumption choices.

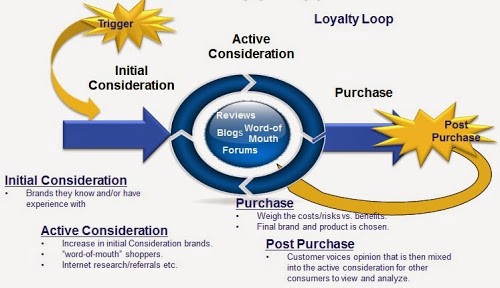

In fact, this is pervasive enough a phenomenon that McKinsey released a report detailing the ‘new consumer consideration journey’ that involves significant use of mobile technology (‘Mo’) for comparison shopping, feedback via local (‘Lo’) or personal social networks (‘So’), all for purchase and post-purchase choice validation, and all while even still standing at-shelf.

McKinsey Model for New Consumer Consideration Journey: Iterative, Cyclical, Social, Digital, Mobile

Physical and Digital Shopping Have Converged: ‘Omni-channel’ is the Only Channel

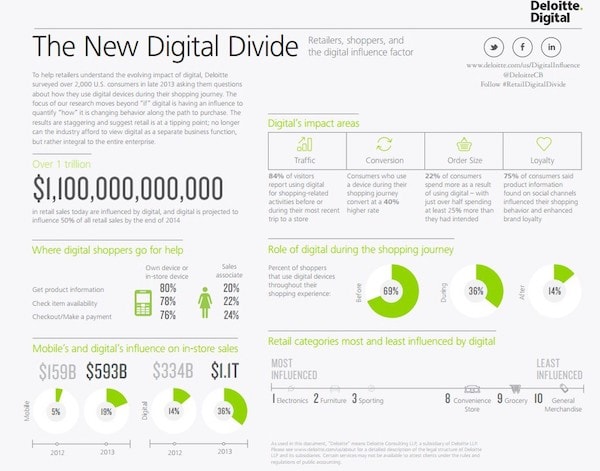

A study released by Deloitte indicates that shoppers and retailers are not only at odds currently with shoppers’ digital, mobile, and tech use outpacing retailers’ ability to innovate and keep up (what they call ‘the digital divide’), but that certain categories are unexpectedly doing very well through digital channels — specifically the ‘toddler/baby’, ‘home improvement’, and ‘home furnishings’ categories. So why is this surprising and what consumer segments are driving all this digital divide and change at retail? What can this data help us predict about the coming years?

The Digital Divide Infographic, Deloitte Digital

Last year almost 85% of individuals who had babies in North America were Millennials — individuals born between 1980–2000, the progeny of ‘Boomers’ — who are the healthiest, wealthiest, ‘spendiest’ generation to have ever lived. The Millennials are stereotyped as digitally-enabled, technologically-mobilized, self-centered, finicky, entitled, and ultimately concerned with lifestyle and status (they witnessed their parents ‘have it all’). Combine their tech-savviness with a taken-for-granted fact in the consumer behavior discipline is that changes in life-stages (e.g. high school to university; university to home-buying; home-buying to marriage and baby-making) creates flux in consumer spending in order to furnish their new lifestyles and new life spaces.

Put all the data together and you don’t just get a forensic account of changes we’re already seeing — you get a picture of the future.

Expectant Millennial Mother Comparison Shopping At-Shelf on a Tablet

The first wave of Millennials are starting to have children this is a phenomenon that will increase before it ends: we can expect that for the next 10 years Millennials will be having babies at rates at least as high as 85% of the child-bearing population. In other words — retailers load your virtual pricing guns, the Millennials are switching life-phases, adding to the human population, settling down with home and hearth, and they are going to need to buy a lot of stuff to get themselves through it — oh, and they will be purchasing much of it online, validated through social networks, accessed on mobile technology. Banks should start beefing up TSFA and RRSP offerings; Volvo’s ‘safe’ cars are likely to have renewed popularity, especially if they are fuel efficient; Home Depot should offer pre-fab home furnishings as well as DIY materials geared to our Millennials as well, who soon, will be batting down the doors in droves. All this, while ensuring absolutely that — as a retailer — you have robust online presence, distribution, and ease-of-access.

Click the image below to see Kristina Partsinevelos and Dr. Brynn Winegard Discuss Millennial consumption and purchasing through social, mobile, digital platforms on the Business News Network:

Shopping on Snapchat, Instagram

So What Should Canadian Retailers Do?

As the Deloitte report indicates, the first challenge will be in realizing that when everyone is online all the time through mobile tech, the concepts of ‘online’ and ‘offline’ are both rendered obsolete — omni-channel is the only channel. Every retailer has to be everywhere, and if you can only choose one modus of distribution (on-line versus off-line), be available virtually. To Millennials internet is like oxygen (especially the subgroup termed ‘digital natives’ who were born with the internet and don’t know a world without it) — if you’re not offering an e-commerce, digital, omni-channel platform as a retailer, it’s as if you don’t exist. When Facebook was first announced, Canadians were among the innovative adopters with the city of Toronto having the highest single population on Facebook for a while in the mid-2000s. In fact, trusting, non-cynical Canadians lead the pack when it comes to shopping online and trusting e-commerce sites — they are an affluent, friendly bunch aren’t they?

Younger Canadians are Trusting Early-Adopters for E-Commerce Offerings

Take it from Best Buy Inc. — who last year released its new ‘Marketplace’ platform that allows not only Best Buy purchases through omni-channel, but includes the option of purchasing from other retailers as well — in a virtualized, network of partnerships — in order to cash out with in a single digital shopping cart. Canadian Tire (who currently has a website with no shopping options) just had their annual summit to discuss their plans for the next calendar year — no surprise to hear that they too are planning omni-channel, digital, e-commerce initiatives to meet the Millennial market halfway.

A new report released in mid-May 2015 highlights that Toronto is in fact the “Hottest Retail market in the Americas” as a destination for international retail brand expansion — beating out New York, Mexico, Buenos Aires and even the city of Angels. Initially, this sounds surprising, but not if you consider that we have:

· Ease of entry into the country for retail brands (as evidenced by an influx of US retailers in recent years such as Target, Nordstrom, Saks 5th, J. Crew, the list goes on)

· An affluent population backed by a natural-resource-fueled, socialistic economy

· A diverse population with global ties and assets

· Millennials shifting life-phases, shopping their way into a new life space, adopting technology at innovative rates, trusting of e-commerce platforms and one another, and due to pump out babies and add to the population for the next ten years.

In short, the retail strategy should be:

· Accept and adopt social, mobile, digital technology in stores and online;

· Have fully-integrated omni-channel, e-commerce platforms (Canadian trust and use them!);

· Offer what Millennials will be shopping for (baby, toddler, kids, recreation, automotive, hardware, home furnishings, entertainment, education, nutrition, health care).

Learn more about how Dr. Winegard’s insights on business brain sciences can help your organization achieve success by checking out her speaker profile or by contacting us.

Learn more about how Dr. Winegard’s insights on business brain sciences can help your organization achieve success by checking out her speaker profile or by contacting us.